Risk Management In Micro Small Medium Enterprises (MSME)

Risk Management In Micro Small Medium Enterprises (MSME)

Over the years, risk management has been identified as a vital process in the business institutions. It is further believed that risk management is less developed within the small business sector where strong enterprise culture can only help in managing risk in a professional and structured way. This study focuses to investigate the risk management practices small and medium enterprises in India.

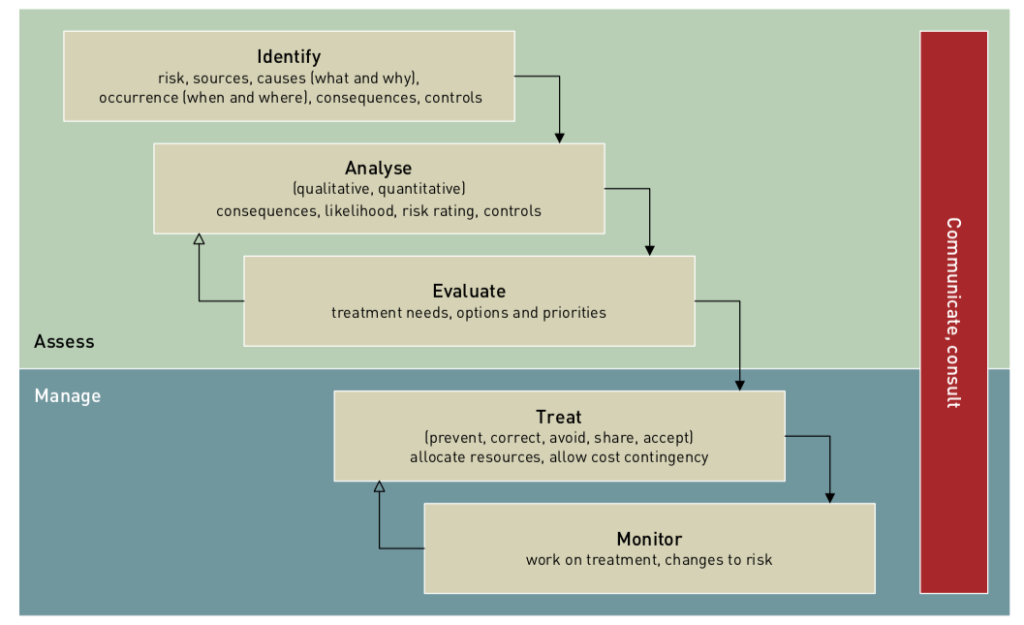

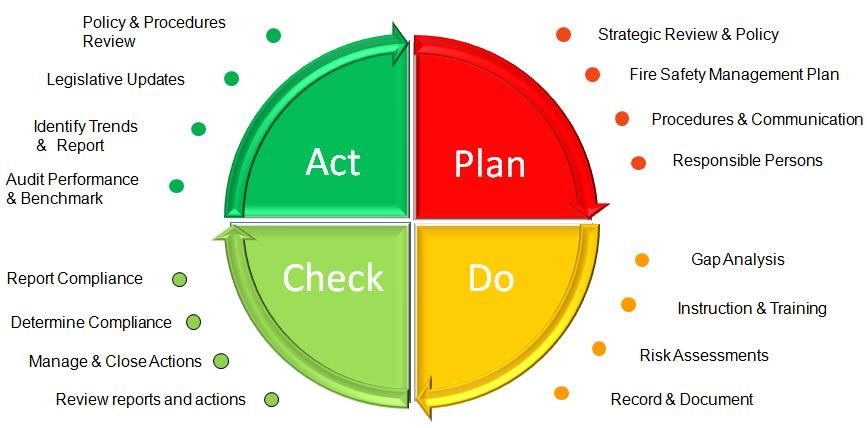

Risk management highlights the fact that the survival of a business entity depends heavily on its capabilities to anticipate and prepare for the change rather than waiting for the change and then react to it. It should be clearly understood that the objective of risk management is not to prevent or prohibit taking risk, but to ensure that the risks are consciously taken with complete knowledge and clear understanding so that it can be measured to help in mitigation.

The prime functions of risk management are to identify measure and more importantly monitor the risk. Risk management activity is a pro-active action in present for securing the future. Managing risk is nothing but managing change, before the risk manages the persons concerned. Undesirable events, the probability of their occurring and their possible impact vary considerably from business to business and from industry to industry. How does a business identify and manage these particular risks?

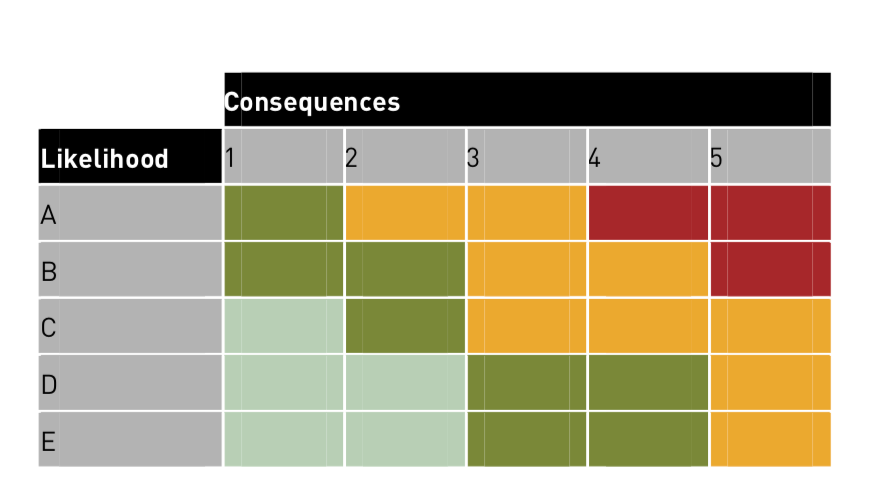

Project Risk rating matrix

Risk rating is determined by plotting likelihood and consequence. The risk rating acts as a prioritisation mechanism for actioning the risks, and can be used to deve lop specific responses to the risk if required.

Low risk

Manage by Routine Procedures

Moderate Risk

Management responibility must be specified.

High Risk

Senior Management Attention Needed

Extreme Risk

Immidiate Action Required

Preparation of Risk Register containing all possible Risk/ Hazards in the process

Risks faced by MSMEs

Small to medium businesses are exposed to risks all the time. Such risks can directly affect day to-day operations, decrease revenue or increase expenses. Their impact may be serious enough for the business to fail. Most business managers know instinctively that they should have insurance policies to cover risks to life and property. However, there are many other risks that all businesses face, some of which are overlooked or ignored.Financial Operational

Every business is subject to possible losses from unmanaged risks. Sound risk management should reduce the chance that a particular event will take place and, if it does take place, sound risk management should reduce its impact. Sound risk management also protects business wealth. Risk management starts by identifying possible threats and then implements processes to minimize or negate them.

Sound risk management can produce the following benefits:

- Lower insurance premiums

- Reduced chance that the business may be the target of legal action

- Reduced losses of cash or stock etc.

- Reduced business down time.

Adequate Risk Transfer/ Adequate Insurance Coverage

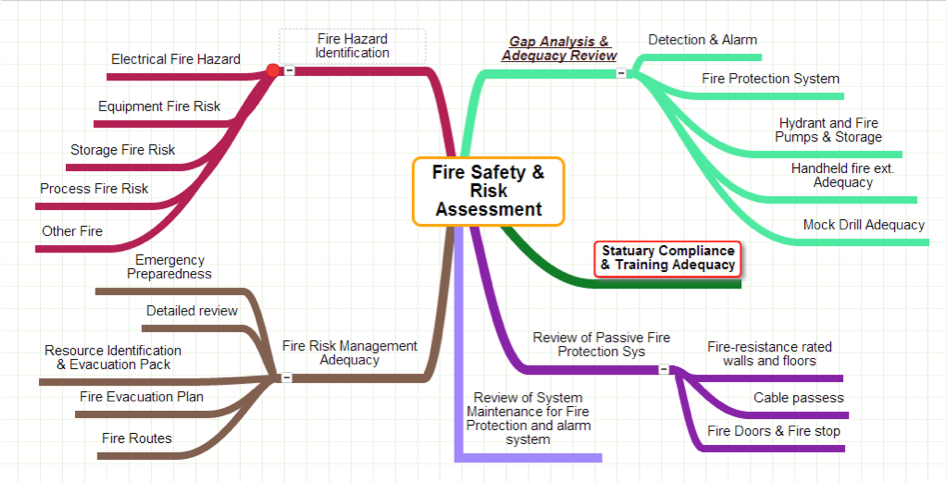

Electrical / Fire Safety Audit

- Safety related to humans- Human safety audit

- Safety of equipment- Equipment safety audit

- Safety of Work Place

- Statutory requirement- Statutory audit

Energy Audit

Emergency Preparedness

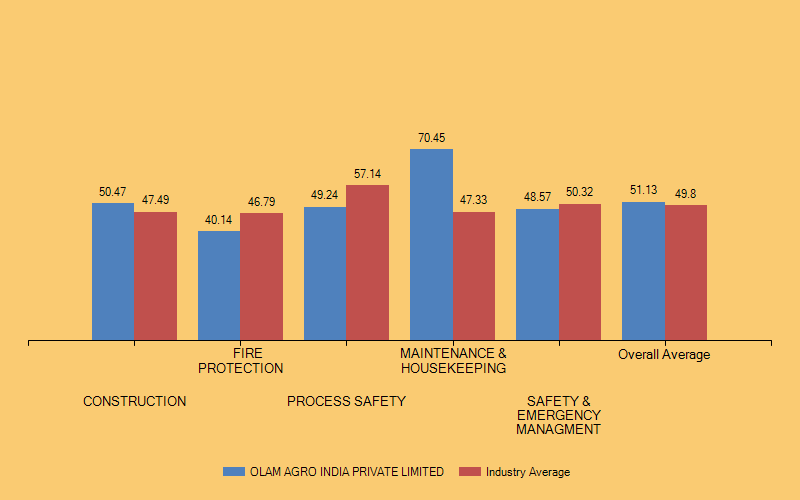

Benchmarking

Industry risk profiling is based on the visual inspection and on the data provided by the site officials we were further analyzed along with other similar industries to profile said site on various parameters in terms of overall industry practices.

Industrial Risk Profiling